Being on a budget is rough and I’m not just talking about dealing with all the sales alerts emails. For the record, I deleted most of the alerts because the temptation was just too great. Out of sight, out of mind.

Being on the dating market can be just as rough. Lately, I’ve noticed a shift in my conversations with friends. Less about boys, more about budgets. However, there isn’t a whole lot of difference between the two topics (sorry, guys). Both processes center around trial and error to see what you like and what you don’t like. My pathway to budgetary bliss has been a rocky one but I think I’ve got the topic down pat. Guys, on the other hand, are still a work in progress.

Temptation to spend money is all too powerful and easy to give into, particularly when you have a debit card. You spy an item you want, you swipe the card and you walk away without really comprehending how much you just spent. It’s the financial equivalent of a one night stand.

My parents suggested I start writing down everything I spend so I gave it a whirl. I used a checkbook register you can pick up at your local bank. It was easy to use and fits into my tote’s compartment, all ready to go.

I like the register because you can immediately do the math to (sadly) watch your balance decrease but it keeps you honest with your number crunching. I’m on a spending freeze but how adorable are these {checkbook covers from Vera Bradley}?

If you’re going to budget, you may as well do it in style. Vera has several cute patterns on sale for $11!

While the register worked well for the mathematics of budgetting, my existential question, “Where is all my money going?” was not yet quite answered. I tried apps like {Mint.com} to track my spendings but I wasn’t thrilled with the service. I often will use cash for transactions and Mint relies heavily on debit and credit card use. This means I’d have to create separate transactions to follow the paper trail and it became too high maintenance for me. Plus, they email your weekly summary on Friday night. Talk about a buzzkill.

Mint.com wasn’t my budget beau but I know several of my friends swear by it. My monetary match though was right around the corner…

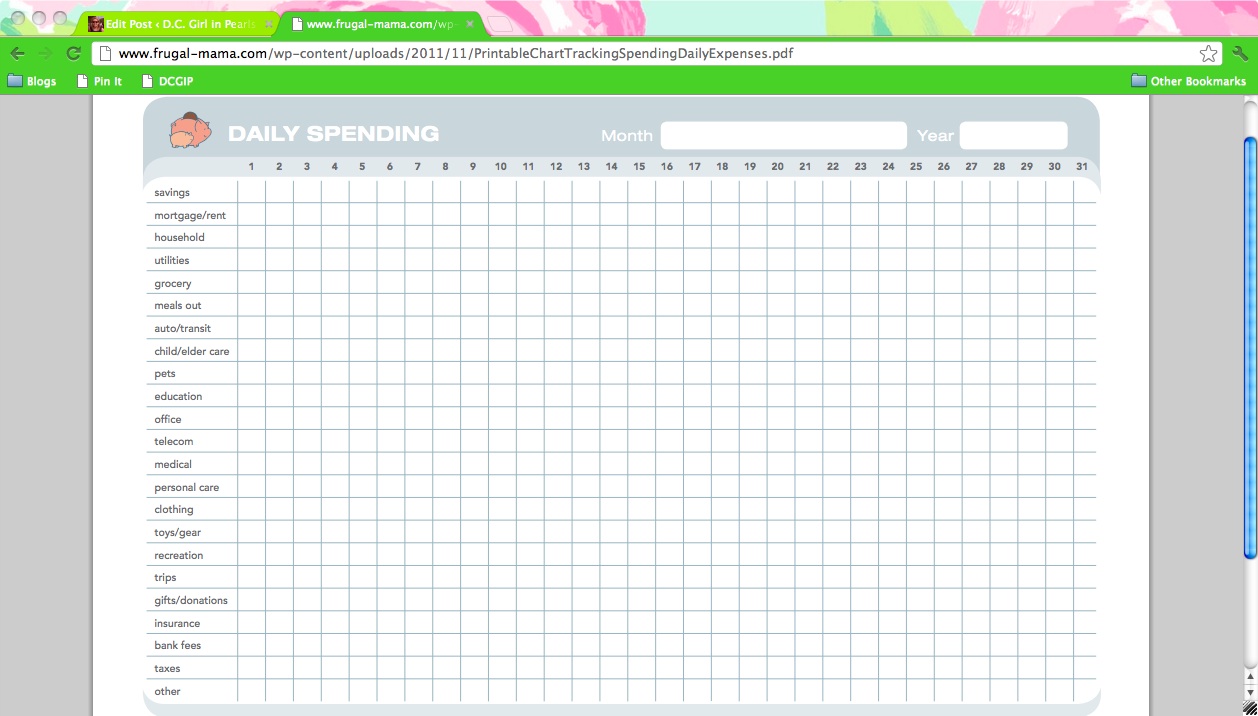

A week ago, I babysat for the mommy blogger {Frugal Mama}. I perused her site before I went to her lovely home and stumbled upon her {Chart for Tracking Spending}. I found the missing piece in my budget.

Image c/o Frugal-Mama.com

I love the piggy bank at the top! The top row lists the days of the month while the side column lists categories for spending, i.e. groceries, meals out, transit. There are some categories that do not apply to my budget such as utilities, pets, office, toys/gear, etc. so I crossed them off to let my chart reflect me.

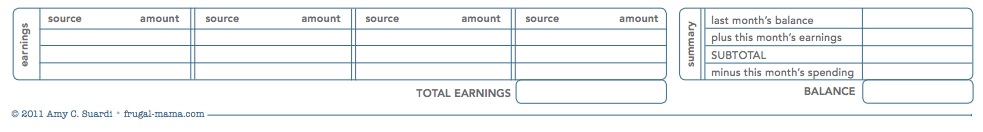

At the bottom is an “Earnings” mini-chart to write down all income you earn during the month. The final piece de resistance of the chart is the “Summary.”

Last month’s balance + This month’s earnings – This month’s spending = Balance

While this may seem a bit overzealous, writing everything down in a chart form works for me. I not only see which categories my money goes to (cough cough meals out cough cough) but on which days. So far my pattern has been to spend very little during the week but then spend more freely on the weekends. Because of this chart, I have a visual guide to see where to cut my spending and be more mindful.

There is not one right way to budget and track your spending. It’s trial & error to discover and fine-tune a system right for me. I love to write everything down and I am a fanatic about Post-Its (my planner is covered in them!) so this chart coupled with my register is the answer to my budget prayers.

In a post-grad recession world, budgeting has become the new dating. You have to kiss a few frogs (Mint.com was the budget equivalent of the needy boyfriend) before you meet your perfect match.

How do you track your spending? Will you use this chart?

I feel like all I talk about these days is budgeting! Especially with a wedding just around the corner…great post!